If you hoped to construct your self an oasis of calm away from the cryptocurrency storm by merely leaving any dialog as quickly as you hear the sound ‘bitc…’ begin to emanate from somebody’s face-hole, I’ve bought some unhealthy information for you. The results of the alt-money goldrush are now not confined to twitchy-eyed evangelists and screechy information headlines – for the second time in latest reminiscence, it’s triggered an enormous spike in graphics card costs, each new and second-hand, because the crypto-clan rush to snaffle up any GPU they may probably use to mine blockchain currencies equivalent to Ethereum and Zcash.

This means two issues for us, in observe. 1) Now is the worst attainable time to purchase a brand new graphics card for gaming, and no-one is aware of how lengthy this may stay the case 2) now could be the very best time to eBay any outdated graphics playing cards you’ve bought sat round. Case in level: I simply bought virtually twice the value for my outdated 2015 Radeon that I might have carried out if I’d bought it two months in the past.

One factor I’m not going to do right here is get into any hypothesis about the way forward for cryptocurrencies, past observing that their rise, fall or consistently spiking variations thereof will immediately have an effect on graphics card costs till if and when one thing vital occurs both in the entire crypto business or AMD and Nvidia impose some form of resolution and/or restriction. I wish to follow what this implies for us, as gamers of PC video games in early 2018.

Let’s take the case, as an example, of the Nvidia GeForce GTX 1070, a card that for the final yr was one of many go-to GPUs for individuals who wish to play new PC video games at near-maximum settings at 1080p or QHD with out breaking the financial institution. Even as just lately as mid-December, you may decide up a GTX 1070 for as little as £350.

Today? Well, for starters you virtually actually received’t have the ability to discover one direct from a retailer, be that top avenue or the likes of Amazon. They’ve all been purchased up and both devoted to mining or scalped onwards. The ones you’ll find are by and huge restricted to resellers on Ebay and Amazon, with costs massively hiked to mirror the demand. As such, the most cost effective GTX 1070 I can discover on Amazon UK is £522. Almost £200 greater than it could have value only a few weeks in the past – and greater than a mighty GTX 1080 would have value at an identical time.

Some retailers are immediately promoting GTX 1070s, equivalent to Scan – however unhappily they’re priced at £550 minimal, and most are out of inventory and on back-order. That’s the bonkers scenario in a nutshell.

This price-perversion spreads like a stain in each instructions. A GTX 1060 (extra helpful 6GB mannequin) now goes for near what a GTX 1070 ‘should’ value, as an example, the most cost effective coming in at £316 on the time of writing, and many of the pack sitting at round £350. By distinction, as just lately because the closing days of December 2017, you may snag one for £215. That’s round a 50% bump within the area of 30 days.

However, costs for the extra highly effective GTX 1080 and 1080 Ti aren’t fairly as closely affected, as their heavier energy consumption broadly makes them much less proportionally environment friendly for mining, on account of vitality prices and PSU wants. Perversely, proper now it’s even attainable to purchase a GTX 1080 for less than a GTX 1070, though the continued inventory shortages imply you’ll seemingly be in a for an extended wait.

What this implies, unhappily, is that folks with money to flash aren’t too locked out by the blockchain goldrush, however these of us whose means restrict us to mid-range playing cards – the £200-300 bracket – are going to have a really onerous time till both the crypto bubble bursts, or governmental regulation or firm restrictions break up the celebration.

All this impacts AMD, by the best way, with the AMD RX 570 and RX 580 being notably treasured for mining proper now. But older playing cards on the second hand market are additionally struggling/benefiting from the craze. Let me offer you an instance of my very own. For the previous yr, I’ve had a Radeon R9 Nano – a mid-range card at greatest by right now’s metrics – sat unused in a drawer, as I’d upgraded to a GTX 1080 Ti to energy my silly ultrawide monitor final yr.

This card was launched in summer season 2015, and initially RRPed at $650/£450. In 2016, it acquired an official worth reduce, right down to $499/£350. As just lately as December, i.e. mere weeks in the past, I might have been fortunate to get £250 for it on eBay.

Yesterday night, within the identify of experimentation and never for one minute anticipating it to work, I listed it for £380. I figured that in the end I’d decrease that to round £300 and be very happy with that certainly.

When I wakened this morning, it had bought. £380. Guess who’s getting himself a brand new cell phone this yr? But additionally: holy shit, that is so tousled.

The cause for all that is, as I say, crypto-mining. Bitcoin is the phrase on everybody’s lips, however nowadays it’s not notably well-suited to mining, whereas different crypto-currencies equivalent to Ethereum and Zcash are.

Now, I’ll be the primary to confess that I’ve haven’t gone far down the rabbit gap of particular currencies. There are many extra sorts, and which of them are thought-about ‘best’ for mining can change usually, however, as I perceive it, it’s at the moment thought-about the case that Nvidia playing cards are higher for Zcash and AMD playing cards for Ethereum, each of which could possibly be traded for money or Bitcoin, or stored round within the hope they’ll accumulate.

There are a complete lot of individuals going into these things onerous, which suggests shopping for a number of GPUs and setting them to mine all day, each day. Certain playing cards are thought-about candy spots due a mixture of tech and energy draw, and the GTX 1070’s a main instance of that – my Nano, in the meantime, is favoured as a result of it’s additionally very small and thus you will get extra of ’em into one area.

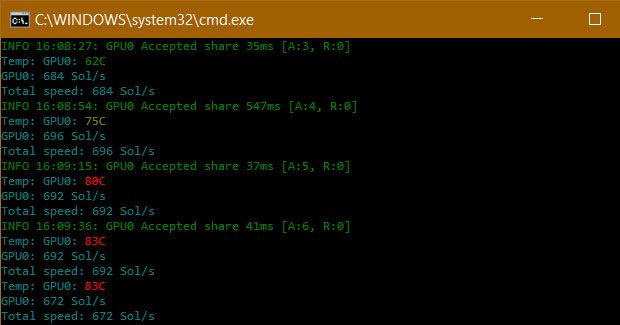

I can’t converse to the precise maths of different boards, however the instance I may give you after setting my PC as much as mine Zcash right now to analysis this piece is that of the GTX 1080 Ti. When mining as a part of a pool (solo mining by and huge requires a complete constructing stuffed with PCs to repay – which is one more reason why playing cards are in brief provide and with loopy costs, as a result of these things actually is going on at an industrial scale), I can count on this card to earn between zero.three and zero.four Zcash, or ZEC, within the area of a month.

Currently, I’ve had it working for simply an hour and earned zero.0004 ZEC. I’ll must money that in for ibuprofen to deal with the headache attributable to the fixed fan noise, and moisturiser for my pores and skin, desiccated by the form of warmth no British room ought to know in January.

After vitality and cooling prices are deducted, proper now this is able to translate to between $110/£80 and $140/£100 monthly, if I bought on the Zcash for typical cash. This would repay the price of a brand new GTX 1080 Ti in mid-to-late 2017 in someplace between six and 7 months, and if I ran it for a yr I’d be £600-700 revenue in addition to having a top-flight gaming card.

This is presuming Zcash and different cryptocurrencies maintain their worth for that lengthy, in fact, which may be affected by all the pieces from investor confidence to new laws, to the mining market changing into oversaturated by all these folks shopping for all these graphics playing cards. It’s additionally attainable charges may climb greater, and thus earnings develop considerably too. But clearly it’s a giant gamble. The extra comparatively cost- and power-efficient mid-range playing cards are thus a extra interesting prospect for the speculative miner.

Personally, I’m deeply disinclined to depart my GPU mining – not simply due to the deep uncertainty round these currencies, but additionally due to environmental impression, noise and warmth era and probably shortening my card’s lifespan. People dashing wholesale into these things don’t care about any of that, in fact, and people working a number of PCs with a number of playing cards can in all probability get themselves right into a scenario whereby they’ll repay substitute boards pretty shortly.

Where does this finish? God, no-one is aware of, however within the brief time period, we’ve bought an actual downside – upgrading our PCs for brand new video games is just about unimaginable proper now, or no less than deeply unwise. It virtually will get right into a scenario the place you have to mine as a way to repay the price-gouge, which is absurd and horrible.

On the opposite hand, you may need some money within the attic should you’ve an outdated card or two sat round. Another instance I may give is that of my even older GTX 970, which I’d have been fortunate to get £70 for a couple of months in the past, however now have an inexpensive shot at £150 if I pull my finger out and listing it PDQ. So there may simply be benefit in promoting your outdated equipment now to fund an improve a couple of months later, when perhaps/hopefully costs may have settled down.

Nvidia and AMD, for his or her half, don’t appear massively inclined to do something about this. It’s good for his or her share worth, in any case. However, Nvidia no less than has made some noises that retailers ought to prioritise game-players over miners, although it’s a suggestion reasonably than a rule, and God is aware of the way it could possibly be enforced.

In the meantime, preserve your improve powder dry, and pray that this yr’s huge video games don’t go too overboard on system necessities. Or as a stopgap resolution, you may check out Nvidia’s GeForce Now cloud gaming thinger, which works a complete lot higher than we suspected it’d.